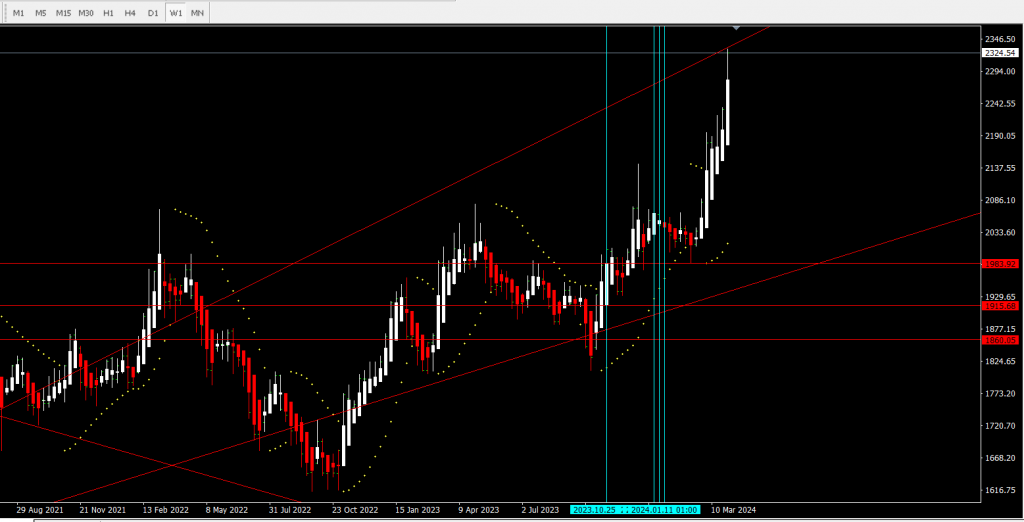

In the last article published on 29.3.2024, titled “Gold at New High: Unbridled Ascent or Resistance in Sight?” I extensively explored the burgeoning gold market and its factors, speculating about its future trajectory. Our primary focus centered on the gold price rally, the potential for a pullback, or a breakthrough to a new bull run. My previous article considered various geopolitical factors, the growing significance of digital currencies, and the potential for a return to the gold standard. In the end, I shared my personal aim to see the gold price reach a daring 2300.00.

Gold has crossed over the 2300.00 mark as of today, April 5, 2024, indicating that all eyes will be on the Weekly chart. The price of gold has stopped short of a key resistance line, which begs the question: Is this a strong resistance level, or could we be on the verge of another thrilling bull run?

While my previous article explored the possibility of a mild or sharp pullback, today’s analysis leans more towards a strong and optimistic belief in the continued upward trend. We acknowledge that various factors could influence the gold market’s behavior—including the escalating geopolitical situation between Israel and Iran, the upcoming U.S. presidential election, the U.S. economic negotiation efforts with China, and possible new virus breakout. Additionally, Gen Z’s increasing penchant for investments adds another layer of complexity to the evolving economic landscape.

Despite these factors, our year-to-date analytics have proven to be on point. We have demonstrated consistency in meeting our annual gold price forecasts, using our M5 to Monthly timeframe charts as evidence of our market anaysis. Therefore, based on our continued vigilance and success in the past, we trust that our upcoming 2024 gold price predictions will continue current direction.

In conclusion, as much as we embrace the possibility of a gold price pullback, our research for 2024 suggests that the upward trend will sustain a bit longer this time. We will keep on monitoring all related data, and update our analysis.

External Read: